Are you ready to elevated your home’s aesthetic of boost its market value? Here are 8 transformative home improvement projects that will accomplish both. From breathing new live to outdated interiors, to amplifying curb appeal with exterior upgrades, these strategic tasks are essential for enhancing your living space and bolstering your property’s appeal in the real estate market.

Repaint Interior Walls

Interior painting is one of the most affordable home improvement projects that make a big impact in your home. Not only does repainting your walls increase your home’s value by at least 107%, but it also gives your interiors a brand new look, which is perfect if your aesthetic has changed.

Neutrals are the way to go if you’re thinking of selling your home. Shades such as light grays, beiges, or whites provide a blank canvas look to potential buyers that allows them to visualize how they’d use the space. Light and airy neutrals also make rooms appear larger since they easily reflect light, which is another attention-grabber for buyers.

If you’re not looking to sell but want a new home look, Andre Kazimierski, the CEO of Improovy, weighs in on the trendiest colors to paint your home this year. “This year is a great opportunity to repaint your home’s interior, especially if your wall colors are outdated. Consider repainting your walls in some of the year’s trending colors, including peachy shades, warm neutrals, and pastel blues.”

Spruce Up Your Curb Appeal

If you’re thinking of selling your home, or just want to make a welcoming first impression for guests, focusing on curb appeal is a must. The best ways to start is by keeping your lawn well-groomed, tending to your garden, or freshening your home’s exterior with a fresh coat of paint. Also take some time to walk around your property to look for any repairs that need to be made in your vinyl siding or yard fixtures.

The good news is that yards of any size can benefit from minor touches that elevate the charm in your curb appeal (and your sense of pride). Painting your front door, resealing the driveway, pressure washing, adding pathway lighting up to the porch, or adding window planters and other outdoor decor items are ideas that work for every home.

Repair The Floors

Just like your walls, your floors have a major impact in the design and feel of a room. If it’s been a while since you’ve repaired your floors or if you’re wanting something fresh, add this home improvement task to your list this year.

“If your flooring could use a facelift, replacing it can add value to your home,” says Todd Saunders, the CEO of Flooring Stores. “Many types of flooring can even be installed as a DIY project, such as peel-and-stick vinyl tiles or carpet squares. Choosing an on-trend color or pattern for your new flooring can give any room an instantly updated feel.”

But, repairing your floors requires more than selecting a trendy design. Certain rooms of the home, like the kitchen, require specific types of flooring to withstand the environment and daily wear and tear, so make sure you do your homework before by researching the best flooring types for the rooms you want to repair.

Create An Outdoor Living Area

One of our favorite home improvement tasks of 2024 that pays off tremendously is getting more acquainted with your backyard, specifically, by creating an outdoor living area. Adding a deck or patio to your backyard furnished with beautiful furniture makes your space more functional and inviting. We’re seeing the rise of outdoor kitchens that are taking hosting or get-togethers to the next level you can also enjoy year-round. Not to mention, this enhances the appeal of your home and is a great bonus if you’re planning on selling in the future.

Update Your Appliances

Are you still using a dial stove from the 1970s? Make 2024 the year you replace your appliances with ones that include smart technology. Not only do smart appliances have a 50% ROI, but they also practice energy consumption, which saves on your energy bill throughout the year. These appliances also sport a sleek appearance with their stainless steel or black exteriors that make your home feel modern and trendy. Plus, this is a simple home improvement swap that doesn’t require extensive demolition.

Remodel The Kitchen

The kitchen is the heartbeat of every home and a prime room for real estate, so it’s safe to say this room pays off yearly from some home improvement love. Though it’s one of the more expensive rooms to renovate, there are improvements you can make that fit any budget such as installing new backsplash, updating a few appliances, or putting in a new faucet and sink. If you want to gut the kitchen, consider installing new cabinetry, countertops, or changing the overall flow by making the room more open or adding in an island.

Minor kitchen remodels see an average of 81.1% ROI with major remodels averaging 53.3%1. Though small kitchen remodels can be done DIY style, like updating your backsplash, overhaul remodels that effect the layout of the room or involve the cabinets and countertops are better left to professionals.

Minor Bathroom Touches

The bathroom is another popular room of the home that pays off to remodel, even on a smaller scale. Minor bathroom remodels bring an average ROI of 70.1% after replacing the floors or fixtures like your vanity and toilet2. Cosmetic upgrades in this space goes a long way in improving the overall look, but you can take it a step further by increasing durability in the room with the help of floor or wall tiles. These tiles add decorative flair with their colors and patterns while being water-resistant, or you can play with patterns in the form of wallpaper for your bathroom design.

Replace Old Windows

Replacing old windows is a more subtle home improvement project, but the good news is that it has one of the highest ROIs. It’s possible to get an 85% ROI by replacing outdated windows, depending on how many you replace or add in. With a plethora of window styles available, new replacements can brighten the exterior of your home while increasing insulation that saves on your heating and cooling bills.

*From SouthernLiving.com 01/30/2024

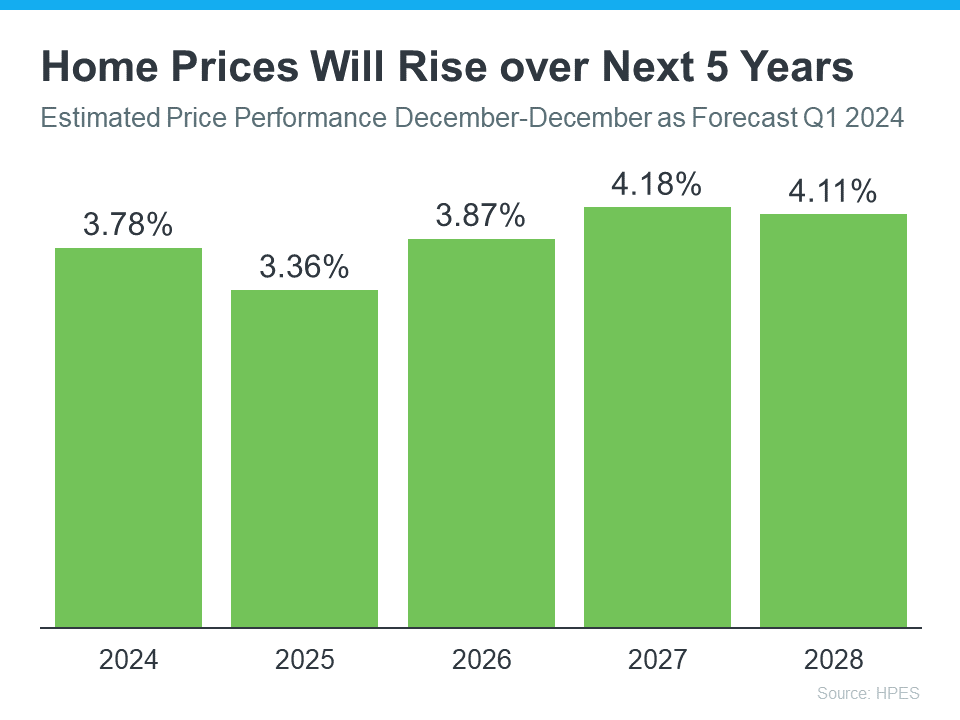

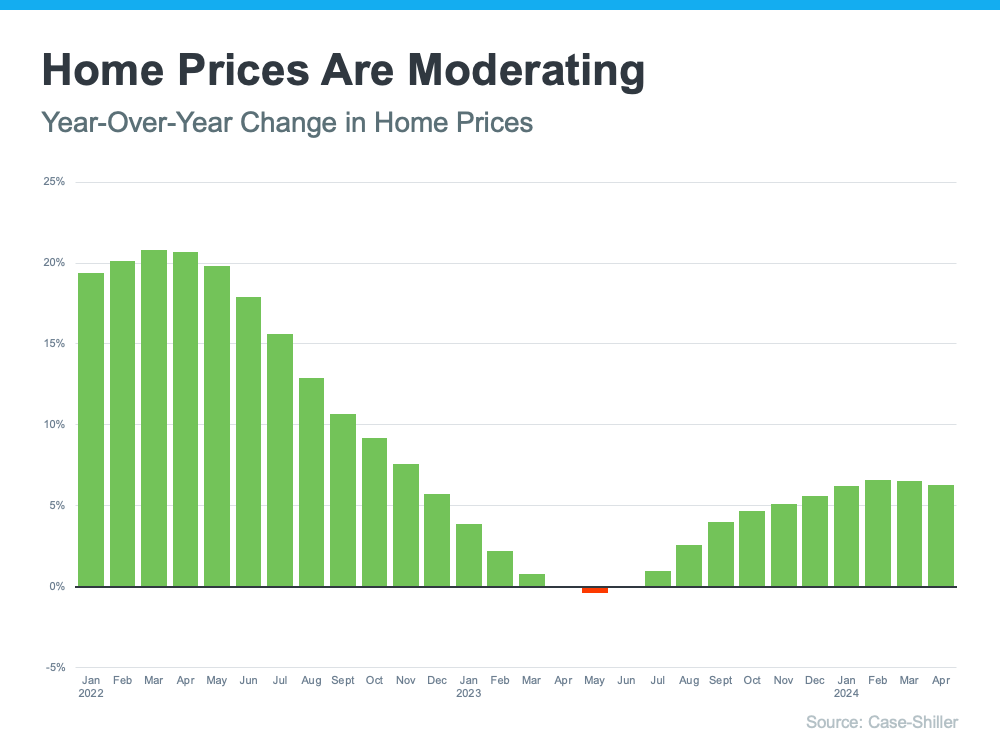

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link