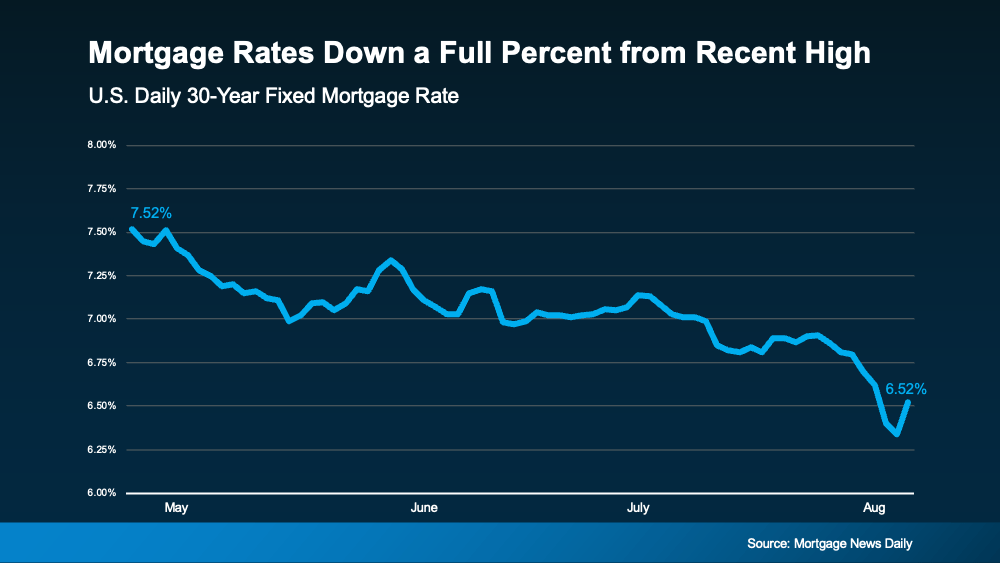

It’s easy to get caught up in the idea of waiting for the perfect moment to make your move – especially in today’s market. Maybe you’re holding out and hoping mortgage rates will drop, or that home prices will fall. But here’s what you need to realize: trying to time the market rarely works. And here’s why.

There is no perfect market.

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing. That’s just the reality of it. If you’re not sure you buy into that, think back to the last 5 years in housing.

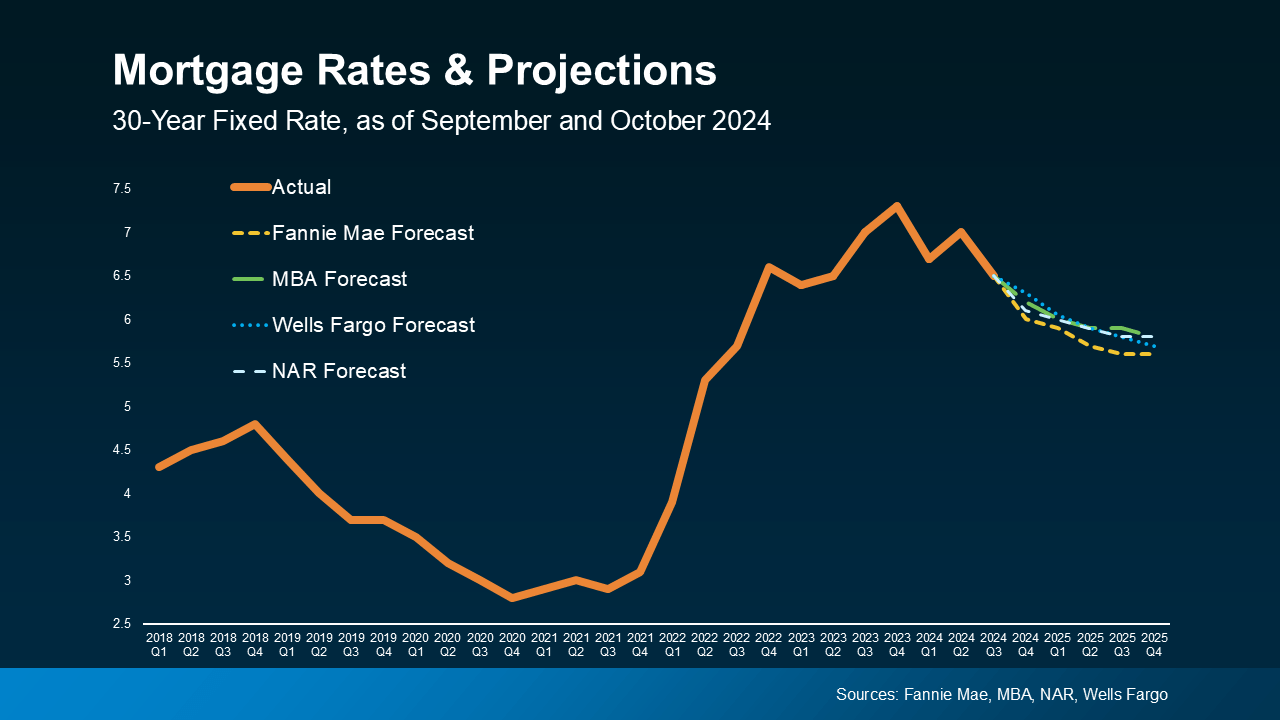

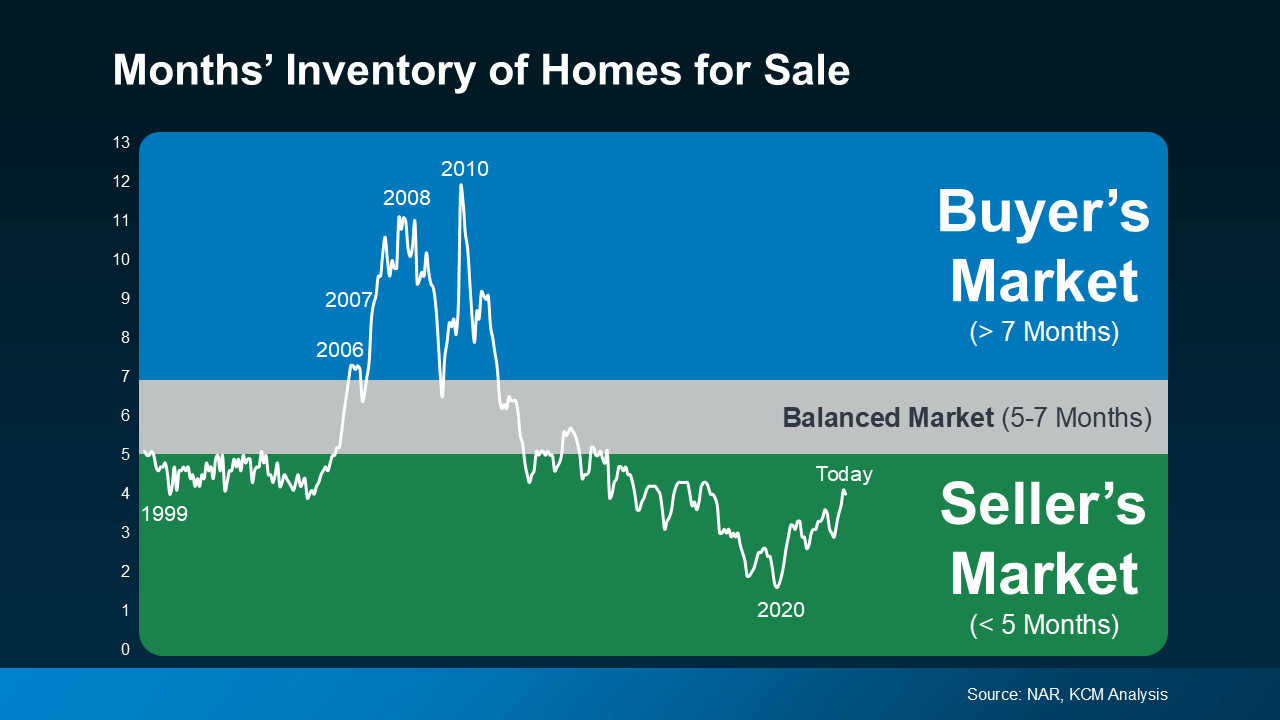

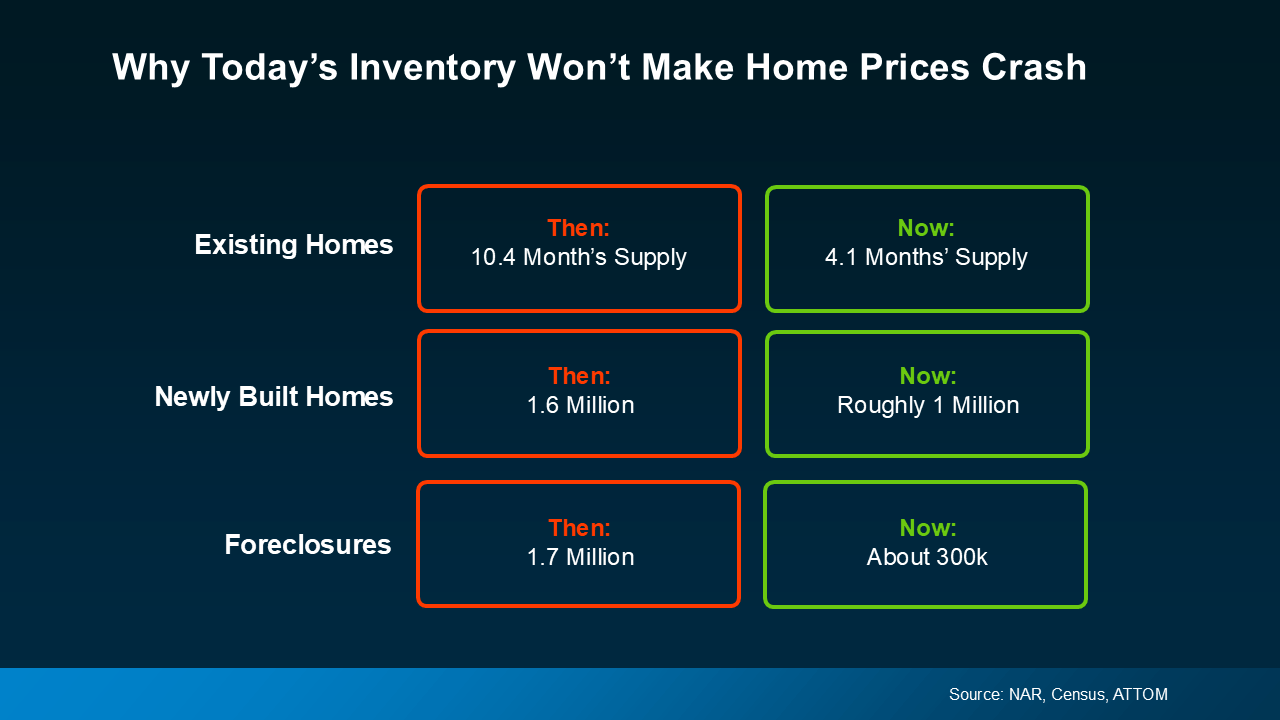

Just a few years ago, mortgage rates hit a historic low. To take advantage of that, a ton of buyers rushed to buy a home and lock in those lower rates. The side effect? With such a big increase in how many buyers were purchasing, the homes on the market were snapped up fast. And since that resulted in so few homes left for sale, bidding wars became the norm and home prices went through the roof. Those buyers got a great rate, but they had other things to contend with.

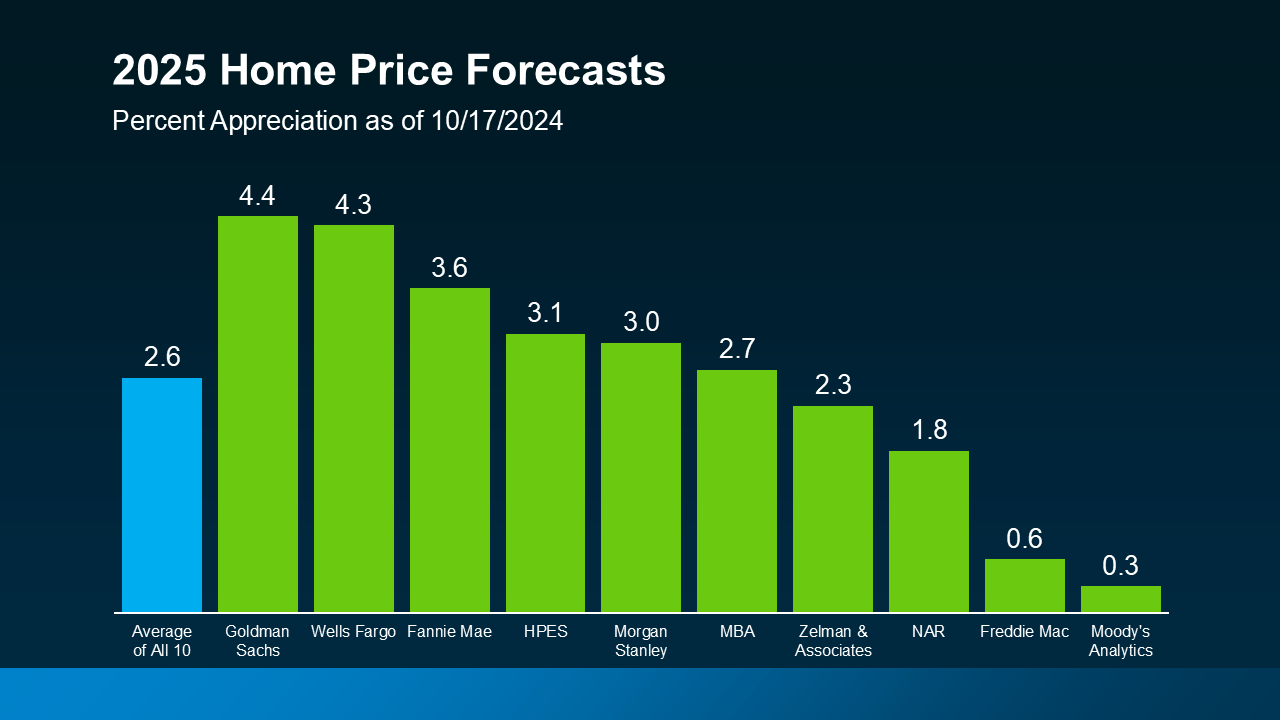

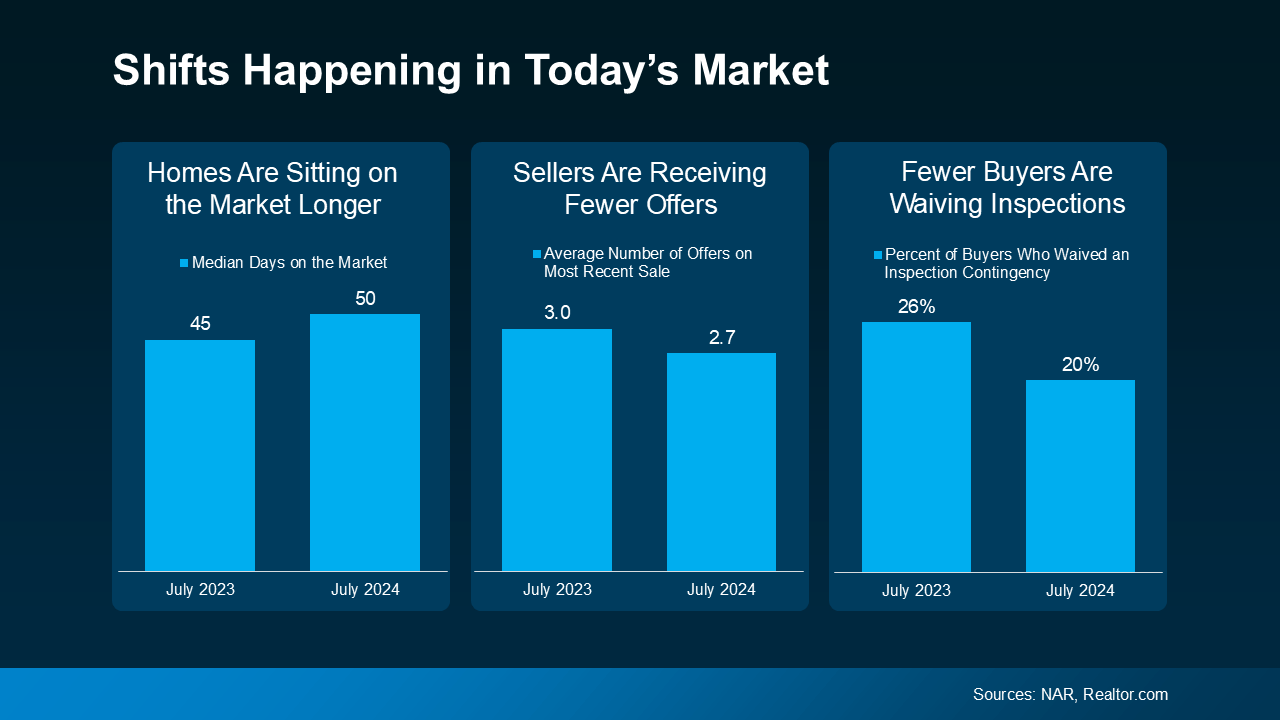

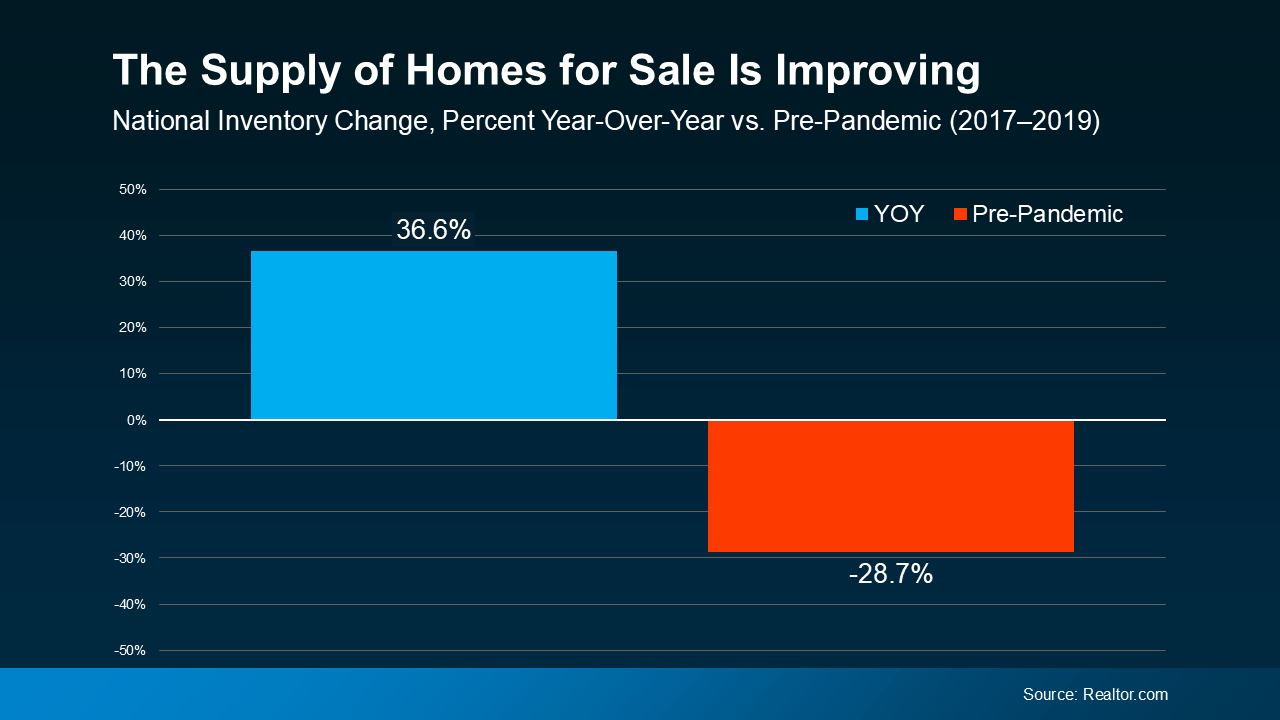

Now, with higher rates and higher prices, it’s more expensive to buy. You can’t argue that. But at the same time, the number of homes for sale is at the highest point in several years. That means you have more options to choose from and you’ll be less likely to find yourself in a pull-out-all-the-stops bidding war. Again, there are benefits and trade-offs in any market.

So, if you have a reason to move and can afford to do so, you’ve got to take advantage of the trends that work in your favor and lean on a pro to help you navigate the rest. As Bankrate says:

“The complexities of the current conditions mean that, now more than ever, it’s smart to lean on the guidance of an experienced local real estate agent. If you want to enter the housing market in 2025, whether as a buyer or a seller, let a pro lead the way for you.”

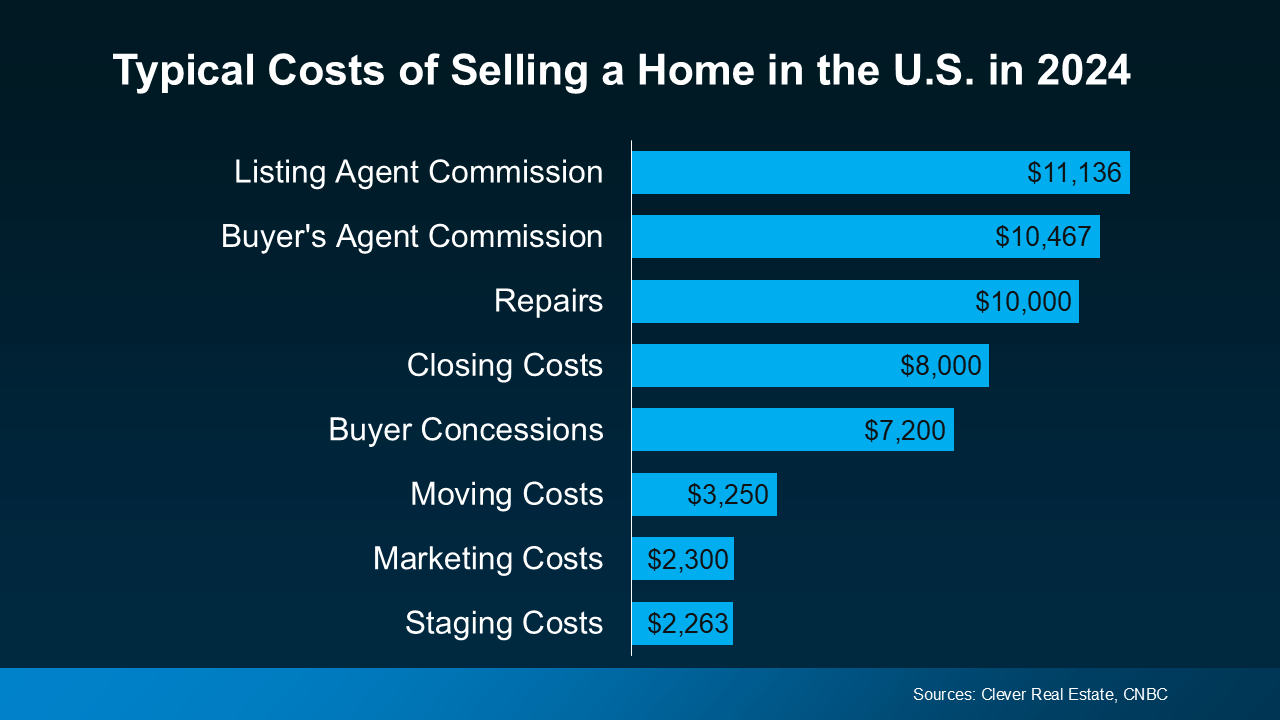

While achieving your goals may feel like an uphill battle in today’s complex market, it is doable. But you’ll need the help of a trusted real estate agent and a lender.

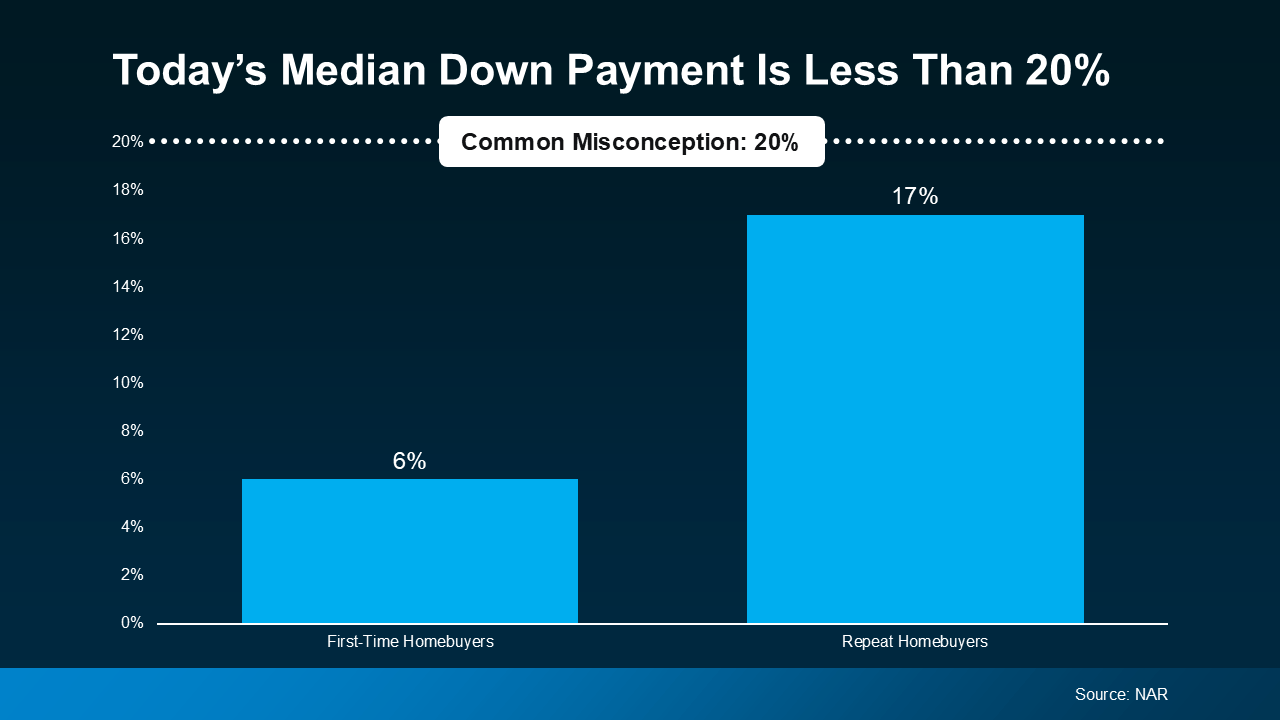

Your agent will help you explore creative solutions – like looking into different housing types (like smaller condos), considering homes that need a little elbow grease, or casting a wider net for your search area. And your lender will walk you through different loan options and down payment assistance programs, so you know what you need to do to make the numbers work for you. As Yahoo Finance says:

“Buying a house at a time when both mortgage rates and home prices are favorable is a challenge. You probably shouldn’t try to time the housing market . . . Buy when it makes sense for you personally.”

Bottom Line

There’s no perfect time to move – every market has its pros and cons. The key is knowing how to make the most of the factors working in your favor. If you need to move and can afford to do it, let’s connect so you’ll have the guidance and tools to make it possible.

*The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link