From Realtor.com

“The fall housing market is beginning to show its true colors—and so far, the outlook appears rosier for both homebuyers and sellers.

Real estate is typically seen as a zero-sum game, where a homebuyer’s gain is a seller’s loss, and vice versa. Yet the latest installment of our “How’s the Housing Market This Week?” column finds statistics for the week ending Sept. 3 shining favorably on both sides of the bargaining table.

First, the good news for buyers is that fall is typically the best time to buy a home—and this autumn is shaping up to be better than usual with a bumper crop of homes on the market with a longer shelf life than they’ve had in the past.

“For today’s home shoppers, there are more homes available for sale, and there may be more time to make an offer on one,” notes Realtor.com® Chief Economist Danielle Hale in her analysis.

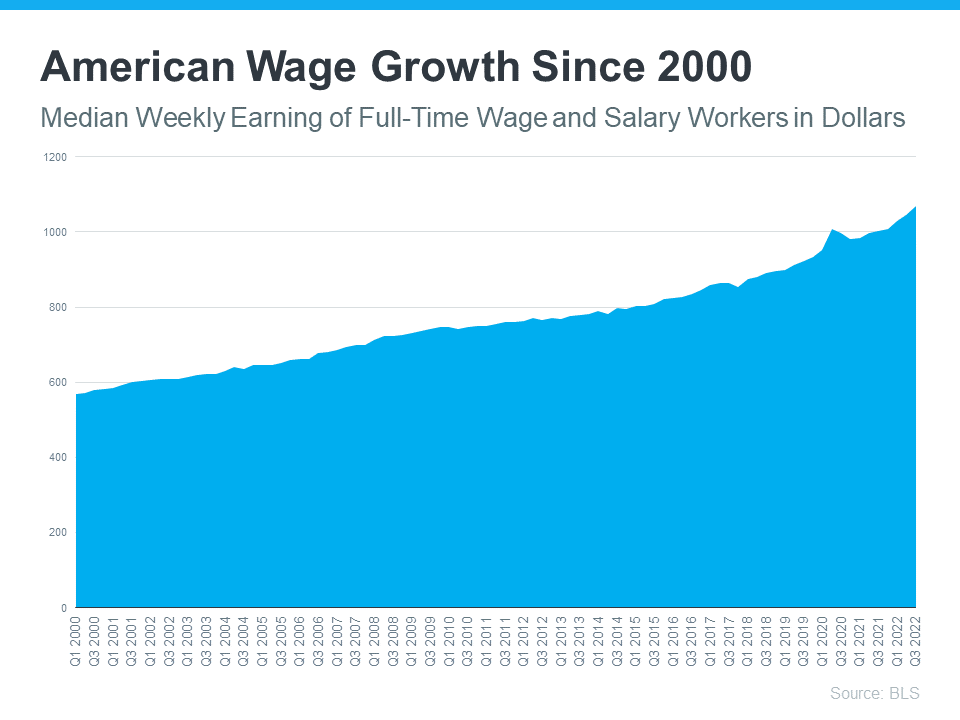

Meanwhile, the good news for home sellers is there appears to be “a renewed recognition of the relative advantages today’s sellers have,” Hale continues. Namely, record-high home equity, thanks to skyrocketing home prices.

Since the numbers never lie, here are the latest figures and what they mean for both homebuyers and sellers so that all can reap the bounties of the fall market.

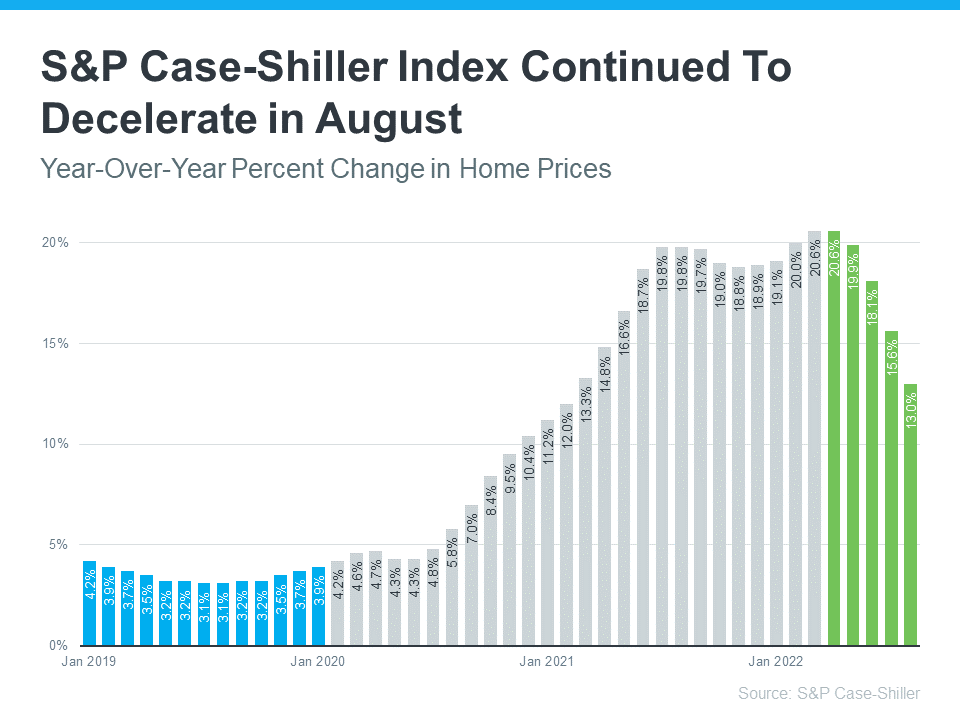

Home prices are still soaring, but heading south for the season

For the week ending Sept. 3, listing prices rose by 13.4% over that same week last year.

“The typical asking price of homes was up from last year by double digits for a 38th week,” says Hale.

Yet month to month, prices are spiraling downward, which bodes well for home shoppers. August data from Realtor.com places the median home price nationwide at $435,000—down from June’s all-time high of $450,000.

“Home prices typically decline as we move into the second half of the year, a seasonal trend that was somewhat disrupted in the overheated [COVID-19] pandemic market,” says Hale. “This year’s data signals a more expected pattern.”

New listings dropped, but there is plenty of inventory

Yes, many home sellers are still kicking themselves for missing the peak of the market. And as a result, a growing number aren’t bothering to list at all. For the week ending Sept. 3, the number of new home sellers entering the market dropped by 6% year over year.

“This week marks the ninth straight week of year-over-year declines in the number of new listings coming up for sale,” says Hale.

Yet this is a smaller dip than seen in the previous three weeks, which experienced double-digit declines. Plus, overall housing inventory—of both new listings and oldies still lingering on the market—ticked up by 27% after an extremely sluggish August.

“The housing market’s rapid growth in inventory from May to July had stalled in August as buyers and sellers adapted to shifting housing market conditions,” Hale explains. “This week’s data snapped a four-week streak of slowing momentum.”

Still, she concedes that new listings are a better barometer of seller enthusiasm and harbinger of what’s to come—and will be the number to keep an eye on going forward.

Home sales are slowing but still brisk

In August, listings lingered on the market a mere 34 days before getting snapped up—that’s 22 days faster than the typical August from 2017 to 2019. But the housing market’s frantic pandemic pace is at long last winding down.

For the week ending Sept. 3, properties spent five extra days on the market compared with a year earlier.

“For a sixth straight week, homes are sitting on the market for a longer time than last year,” says Hale.

Still, this is by no means permission to take your sweet time, with Hale pointing out, “relative to pre-pandemic, shoppers need to make faster decisions.”

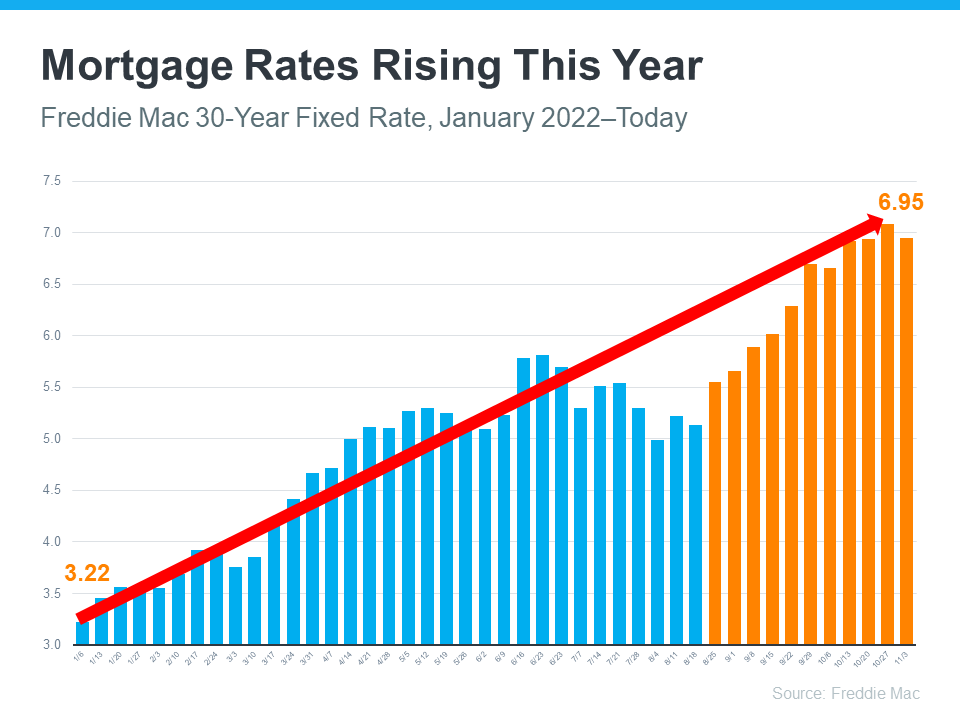

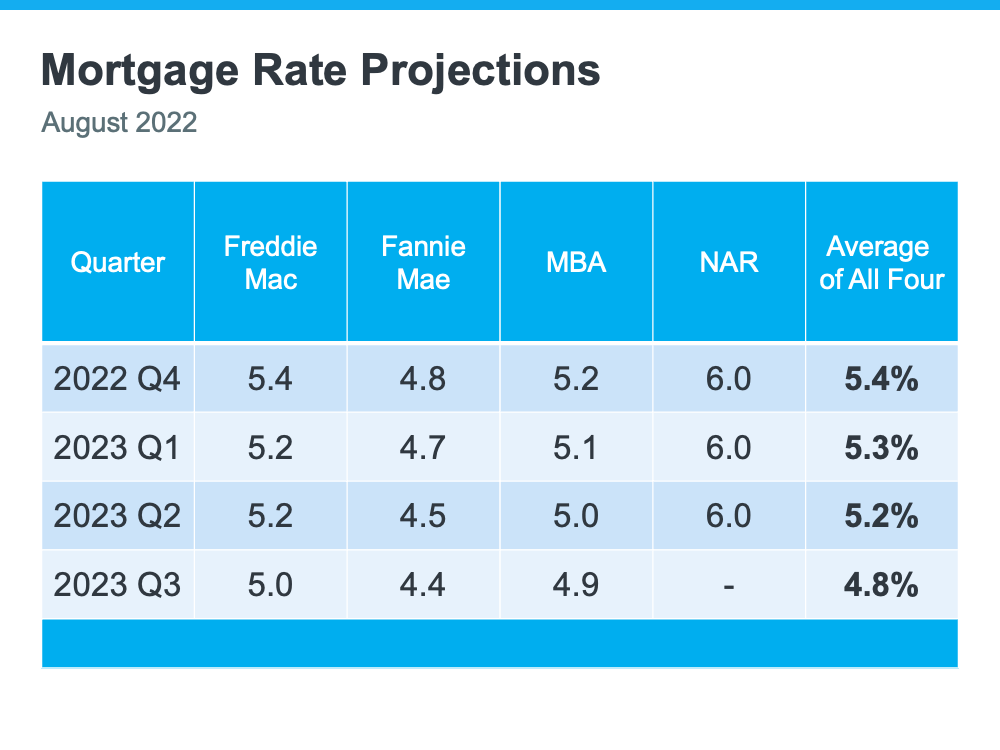

Mortgage rates are up to nearly 6%

According to Freddie Mac, for the week ending Sept. 8, the average 30-year fixed mortgage rate increased to 5.89%, up from the previous week’s 5.66%. That’s a whole lot of pain for buyers that’s bound to put downward pressure on prices.

“Buying a home remains a pricey undertaking as mortgage rates continue to trend higher,” Hale concludes. “As buyers navigate high costs resulting from price gains and mortgage rate increases, sellers will find that they are more price-sensitive and more willing to ask for contract concessions than last year’s shoppers.”

In other words, buyers are driving a harder bargain than they could have during the raging seller’s market of the past. And thanks to those high home prices, sellers who give a little still stand to gain a lot, creating that rare, beautiful possibility of a win-win scenario for all.”

* This article was published on September 8th on Realtor.com. CLICK HERE for the full article

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

![Should You Update Your House Before You Sell? Ask a Real Estate Professional. [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/11/16134552/Should-You-Update-Your-House-Before-You-Sell-Ask-A-Real-Estate-Professional-MEM-1046x2648.png)